Drake Accounting Features

Payroll Module

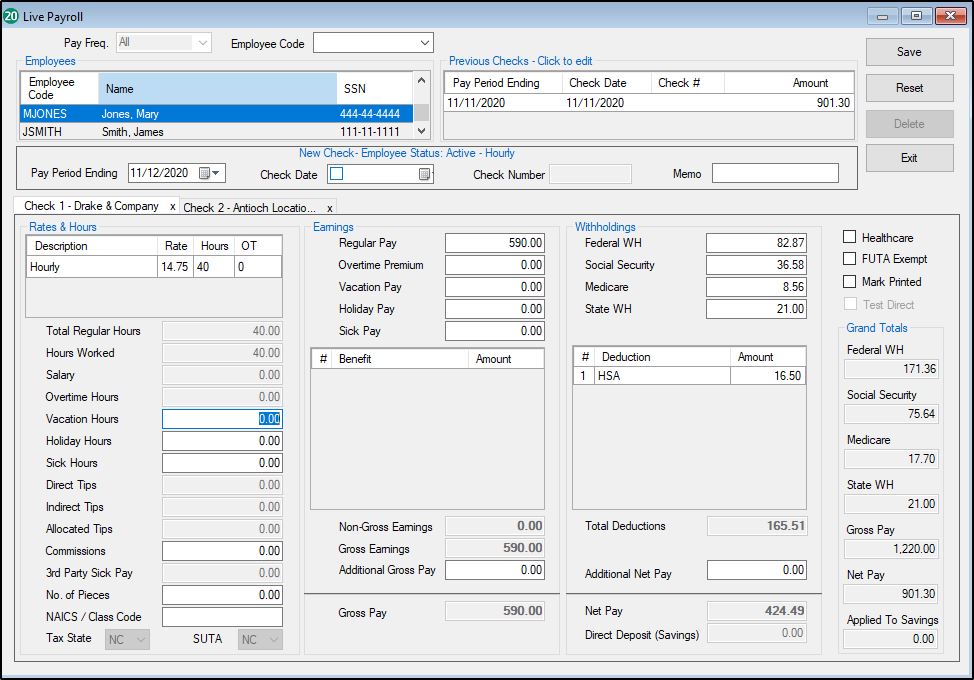

- Live and after-the-fact (ATF) employee payroll including MICR check printing, direct deposit through Kotapay, e-filing quarterly and yearly employment tax forms, and e-filing Forms W-2 and 1099-MISC.

- When multiple locations have been established, set up multiple benefits, deductions, and pay rates per location. Print payroll on one check for all locations or one check per location.

- Employee payroll supports direct and indirect tips, and unlimited payroll benefits and deductions per check. Optionally print other information on pay stubs.

- Override the default payroll general ledger accounts for an employee or vendor.

- Forms 940, 941, 941-SS, 941-X, 943, 943-X, 944, 944-SP, 944-X, 945, 945-X, and W-2 are supported, as well as most state quarterly unemployment forms.

- Forms 8809, W-4, and 8655 are also available.

- Post payroll journal transactions automatically. Payroll journal entries can be created from payroll checks entered, to save keystrokes.

- Customize federal, state and local withholdings and rates.

- DOL rules – Employee Payroll has the option to force the software to use wage and overtime factors that follow guidelines of the Department of Labor.

- Unlimited deductions, benefits, pay rates, localities, and divisions throughout the program.

- Option for an employee to be tipped both directly and indirectly.

Accounting Module

- Set up a custom chart of accounts, import from an existing client, or use a template.

- During setup, change account information as needed, add account levels, enter current budget, starting balances, and export to Drake Tax.

- Make journal entries to one of the five separate journals – general, cash receipts, cash disbursements, payroll, or budget – or save time and have Drake Accounting do it automatically.

- Reconcile cash amounts, post monthly transactions and close at year end, and format financial reports with custom headers, footnotes and logo. View or further customize any of the financial reports using most word processing applications.

- Indicate vendor default accounts for cumulative entries to the journal and by 1099-MISC box categories.

- Edit or create custom journal types and enable detailed descriptions for automatically created transaction entries.

- Update prior year client, bookkeeping and On-the-Fly information without re-entering client information, including payrolls.

- Select a month or year to filter transactions and view their current status: Balanced, Not Balanced, or No Entries.

Vendor Payments & Accounts Payable

- Print and track payments – For live or ATF payments to vendors (1099-MISC) and other payees. Pay by invoice or simply use the "Quick Payments" feature with little or no setup involved. At year-end, create Forms 1099-MISC and print or e-file when needed.

- More deposit accounts – Employee and vendor paychecks can now be direct deposited into two different bank accounts through our partner, Kotapay.

Accounts Receivable

- Track receivables – Send invoices and customer statements and post customer payments, penalties and service charges. Also track past-due amounts and monitor sales tax liabilities (state, county and local).

- Customer credit – Define individual customer credit limits, discounts, and apply a single payment to multiple invoices.

On-the-Fly Forms

Create these federal forms for printing or e-filing where applicable:

- Forms 940, 940-PR, 941, 941-PR, 941-SS, 941-X, 943, 943-PR, 943-X, 944, 944-SP, 944-X, 945, and 945-X

- Forms W-2, W-2G, W-3, W-2c/W-3c

- Forms 1098 (listed as 1098-MORT in the program), 1098-C, and 1098-T

- Form 1096

- Forms 1099-A, B, C, DIV, G, INT, MISC, NEC, OID, PATR, R, and S

Setup and Security

- All-in-one setup panel – Easily set up all the major modules in one place, including Employees, Accounting, Payables, and Receivables. Select options for direct deposit, the MICR Check Designer, and MICR bank accounts, as well as check and stub options for payroll and payables checks.

- Paid preparer setup – Set paid preparers to have their information automatically prefill for state tax forms and 94x series tax returns.

- Custom user setup and permissions – Set up each user in your practice as an owner, administrator or user, with permissions for each set and user as needed.

- Restrict modules – Choose which modules and/or submodules are available to each user.

- Customize the lock screen image – Use your company's logo as the default image when logging into Drake Accounting.

- Journal screen options – Can be set per user, including the ability to disallow posting in the journal screen.

- Rates & withholding – Find the federal, state, and local rates and withholdings setup all in one central location. These amounts and tables can be edited by the user and can be set back to the default rates if necessary.

Importing and Exporting

- Import from other software – Import client, employee, vendor and bookkeeping details from QuickBooks, Sage 50, and Intuit EasyACCT. Import 94x information from Dillner’s Accounting Tools.

- Support for spreadsheets – Import and export spreadsheet lists of employees, vendors, customers, sales tax records, journal entries, and charts of accounts.

- Export to Drake Tax – Export from Drake Accounting to the client’s tax return in Drake Tax.

Data Entry

- Field validation – Small icons appear beside required fields, indicating information that must be completed for e-filing and other tasks. Hover over the icon for a tooltip explanation. Screens and forms cannot be saved until validators are cleared.

Interface

- Alternative desktop view – Just click icons to quickly open screens within each module. This view can be selected per user.

- Forms zoom – Five levels of zoom let you more easily view federal and state forms.

- Simple navigation – A familiar tree menu outline lets you quickly switch to different modules or screens.

- Web links – Convenient access to various websites and resources for the Social Security Administration, the Internal Revenue Service, and the Department of Homeland Security.

E-filing

- E-filing – Drake Software helped pioneer e-filing in 1986. Forms 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, 945, W-2, W-3, 1099, 1096, 1098, and W-2G can be filed electronically using Drake Accounting.

- 94x PIN Application – This application is for a business taxpayer who does not already have a PIN and wishes to request one for their business. Once the application is accepted, the business taxpayer will receive a 10-digit PIN in the mail from the IRS within ten days, so be sure to use this PIN when transmitting the 94x.

- State tax & wage forms – Currently 51 state forms can be e-filed from within the software.

- Viewing 94x acknowledgements – Retrieve your 94x transmission acknowledgements through Drake’s Online EF Database that provides real-time information, or easily retrieve them from within the software.

Working with Clients

- Electronic signatures – Use an electronic signature pad to digitally sign checks and e-fileable federal forms, including Forms 94x, Forms W-2, and Forms 1099, in addition to state tax and wage forms from 50 states and Departments of Revenue & Labor. The fully-integrated e-signature process is authentic, tamper-proof, and securely bound to the document.

Printing and Reports

- Generate financial reports for your client – Some reports include charts and graphs to help you advise your clients.

- Accounting reports – Review balance sheets, budget reports, cash flow reports, profit and loss reports, payroll reports, payables and receivables reports, and many other options to help verify accuracy and to review your client’s financial status.

- MICR printer – This option can be set per user for busy offices that may use multiple printers.

- PDF printing – All forms and documents can be printed to PDF format for digital archiving.

- Mailing labels – Print mailing labels for employees, vendors, customers, and clients using 3 ½ x 1 ⅛ in. roll or sheet labels.

Backups and Archives

- Easily back up and restore client data – Create frequent backups of client files to a secure location for archival purposes. Backups can occur manually or automatically and can easily be restored to continue where you left off.

- Archive and compare – Install Drake Tax to take advantage of the Drake Archive Cabinet to save federal and state forms, as well as any of the reports for comparison and safekeeping.